Article about Grameen Bank

Grameen Bank – a bank for the poor

From Wikipedia

The Grameen Bank (Bengali: গ্রামীণ বাংক) is a microfinance organization and community development bank started in Bangladesh that makes small loans (known as microcredit or "grameencredit") to the impoverished without requiring collateral. The name Grameen is derived from the word gram which means "rural" or "village" in the Bengali language.

The Grameen Bank (Bengali: গ্রামীণ বাংক) is a microfinance organization and community development bank started in Bangladesh that makes small loans (known as microcredit or "grameencredit") to the impoverished without requiring collateral. The name Grameen is derived from the word gram which means "rural" or "village" in the Bengali language.

The system of this bank is based on the idea that the poor have skills that are under-utilized. A group-based credit approach is applied which utilizes the peer-pressure within the group to ensure the borrowers follow through and use caution in conducting their financial affairs with strict discipline, ensuring repayment eventually and allowing the borrowers to develop good credit standing. The bank also accepts deposits, provides other services, and runs several development-oriented businesses including fabric, telephone and energy companies. Another distinctive feature of the bank's credit program is that the overwhelming majority (98%) of its borrowers are women.

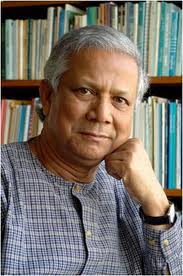

The origin of Grameen Bank can be traced back to 1976 when Professor Muhammad Yunus, a Fulbright scholar at Vanderbilt University and Professor at University of Chittagong, launched a research project to examine the possibility of designing a credit delivery system to provide banking services targeted to the rural poor. In October 1983, the Grameen Bank Project was transformed into an independent bank by government legislation. The organization and its founder, Muhammad Yunus, were jointly awarded the Nobel Peace Prize in 2006; the organization's Low-cost Housing Program won a World Habitat Award in 1998.

Muhammad Yunus, the bank's founder, earned a doctorate in economics from Vanderbilt University in the United States. He was inspired during the terrible Bangladesh famine of 1974 to make a small loan of US$27.00 to a group of 42 families so that they could create small items for sale without the burdens of predatory lending. Yunus believed that making such loans available to a wide population would have a positive impact on the rampant rural poverty in Bangladesh.

The Grameen Bank (literally, "Bank of the Villages", in Bengali) is the outgrowth of Yunus' ideas. The bank began as a research project by Yunus and the Rural Economics Project at Bangladesh's University of Chittagong to test his method for providing credit and banking services to the rural poor. In 1976, the village of Jobra and other villages surrounding the University of Chittagong became the first areas eligible for service from Grameen Bank. The Bank was immensely successful and the project, with support from the central Bangladesh Bank, was introduced in 1979 to the Tangail District (to the north of the capital, Dhaka). The bank's success continued and it soon spread to various other districts of Bangladesh. By a Bangladeshi government ordinance on October 2, 1983, the project was transformed into an independent bank.[8] Bankers Ron Grzywinski and Mary Houghton of ShoreBank, a community development bank in Chicago, helped Yunus with the official incorporation of the bank under a grant from the Ford Foundation. The bank's repayment rate was hit following the 1998 flood of Bangladesh before recovering again in subsequent years. By the beginning of 2005, the bank had loaned over USD 4.7 billion[10] and by the end of 2008, USD 7.6 billion to the poor.

The Bank today continues to expand across the nation and still provides small loans to the rural poor. By 2006, Grameen Bank branches numbered over 2,100. Its success has inspired similar projects in more than 40 countries around the world and has made World Bank to take an initiative to finance Grameen-type schemes.

The bank gets its funding from different sources, and the main contributors have shifted over time. In the initial years, donor agencies used to provide the bulk of capital at very cheap rates. In the mid-1990s, the bank started to get most of its funding from the central bank of Bangladesh. More recently, Grameen has started bond sales as a source of finance. The bonds are implicitly subsidised as they are guaranteed by the Government of Bangladesh and still they are sold above the bank rate.